So You’re Telling Me There’s Insurance for Insurance Companies?

Makes a lot of sense when you consider it, which I don’t think many people do before hearing the word ‘reinsurance’.

I certainly didn’t.

And for those reading whose minds are already asking the follow-up question, “Does that mean reinsurers need insurance, too?”

Yep

At risk of many of your brains shutting down (along with this browser tab), I will mention retrocessionaires - reinsurance companies that insure other reinsurers.

It’s a rabbit hole of risk management that spreads exposure globally to enable you and I to live our lives.

Whether you know it or not, every part of your day is touched by insurance, which is then often reinsured.

It makes all things possible by allowing people and companies to take risks while being protected against the potential of financial loss; this translates to you being able to drive your car, travel to other countries, and buy your morning cup of coffee.

It’s a fascinating, age-old industry with a rich history, sprung from Edward Lloyd’s 17th century coffee shop (which later became, you guessed it, the illustrious insurance market, Lloyd’s of London).

For the layperson wanting a touch more clarification on the basics of reinsurance, read on.

For reinsurance experts, either read through the following section to approve my reinsurance analogy, or jump ahead to the next section to read about the biggest issue facing practitioners at every level of the industry.

What Is Reinsurance & How Does It Work?

What is reinsurance? Re-read the first sentence of this article; that’s the boring, default description.

The much less boring way is through the power of analogy, great for facilitating understanding (which is why we use them so much on The Reinsurance Podcast).

I like to think about reinsurance as the Nespresso attachment that goes underneath my cup to catch any spillage.

I’ll explain.

You hope your coffee won’t overflow and burn your hand or damage your kitchen, should everything go to plan.

However, there could be 1) a machine malfunction, 2) you might accidentally move the cup too far to the left, or 3) a small earthquake might shake something loose (it would have to be a particularly good drip tray to protect against the latter).

The point is, reinsurance protects you against the unknown unknowns, should things not go to plan.

A far more risqué analogy came to mind before making coffee, so my thanks go out to Nespresso.

(This isn’t an ad for Nespresso but, if you are reading this, I am open to hearing creative coffee-reinsurance fusion brand deals).

So, we’ve very briefly covered the ‘what’, now we can similarly crack on with the ‘how’.

The reinsurance market is made up of three key players that create the value chain; cedents (insurance companies who buy insurance), brokers (an important intermediary that crafts complex and bespoke deals), and reinsurers (companies who sell reinsurance to cedents).

That’s all you really need to know for now.

However, should you want a complete breakdown by genuine reinsurance experts, I highly recommend this video podcast that explains how reinsurance works.

Now we can move on to the meat of this article; the systemic problem facing the entire industry (and why I joined Supercede).

The Desperate Need for Better Reinsurance Technology

Reinsurance is a big industry - total capital to the global market measured USD 728 billion in 2021.

You might imagine then, as I did, that reinsurance practitioners across the value chain would enjoy access to all manner of brilliant technology that enables effective working and efficient communication between clients and partners.

You’d be wrong.

But not just wrong, extremely wrong.

The majority of reinsurance professionals are forced to get by with nothing more than spreadsheets, emails, and FTP servers (file sharing websites made necessary due to email file size limits).

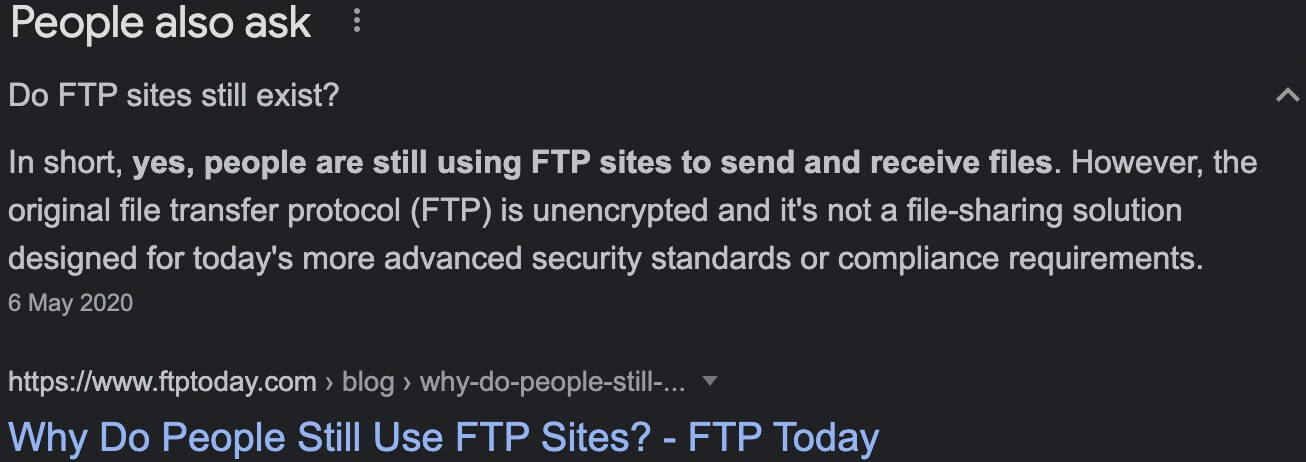

A quick web search of ‘FTP sites’ brings up this ‘People also ask’ suggestion:

If there’s a question around whether your day-to-day technology still exists, maybe it’s time to upgrade.

Coming from an enterprise SaaS background, I thought reliance to this degree on legacy tech was shocking, bordering (bordereaux-ing?) on insanity.

I learned that reinsurance practitioners face massive inconveniences, things which most other industries had already solved for.

How could an industry this big have such a lack of innovation?

Currently, the only reason anyone working in reinsurance puts up with these problems is because they don’t know any better.

I’ve never known an industry with such high levels of consumer inertia.

Cedents spend months preparing large amounts of submission data using Excel (not even Google Sheets!), with so many rows of data that a crashing computer is commonplace.

The solution? Divide the large spreadsheet into smaller spreadsheets.

It might be better for your computer but it’s worse for your soul.

Once that ordeal is over, everything’s sent to the broker who refines the information and packages it into a ‘deal’ to send to the right reinsurers.

The last part might not sound so bad, however the amount of back-and-forth in messy email threads is enough to give the average person motion sickness.

I understand that when something works, those who are more conservatively minded tend to stick with it.

It’s understandable to balance the risk of change against potential business interference when it might only produce a small increase in performance.

That’s no longer the case.

Reinsurance hasn’t had an upgrade in so long that differences in tech now produce magnitudes of difference in performance.

Imagine a Windows 95 Machine Next to the Latest Macbook Pro.

Our industry is painfully lagging behind.

Companies that fail to improve their technology will diminish, for at least these two reasons:

- The increase in time-saving, efficiency, and scalability is becoming laughable when comparing legacy technology to what’s currently available.

- Young talent doesn't want to work with outdated boomer tools.

It’s not all doom and gloom, though!

This is the part where I tell you why Supercede is the saviour of the reinsurance world, in a totally unbiased way, regardless of the fact that they pay my rent.

Podcasting, Memes, and Revolutionising Reinsurance

There’s no software built specifically for reinsurance.

Aside from Supercede.

And it was built by genuine reinsurance experts; practitioners across the value chain who spent years working within the confines of the status quo.

That is, before becoming fed up and deciding to do something about it.

Supercede’s at the forefront of innovation in an industry primed for better tech:

Why spend 3 months in data preparation hell when there’s a solution that can lift you out of misery and complete the same task in 2 weeks?

Why use multiple systems which aren’t fit for purpose when you can access everything you need in one platform?

Why use outdated technology that severely hinders your workforce when they could be doing so much more?

The main reason I chose to jump into reinsurance, anindustry with which I had no prior experience, is this: Supercede solves far too many problems.

I can’t imagine a future world where a platform like ours isn’t ubiquitous.

And I invite you to see why.

Here’s the very first podcast episode we filmed where the founders, Jerad and Ben, explain who we are, what we do, and why it’s important:

The podcast has come a long way since then; it’s grown into the principle reinsurance podcast (we didn’t have too many reinsurance-specific podcasts to compete against), with esteemed guests and games of Analogy Battle, Price It, and Frisk Risk, enjoyed by a global audience.

The people behind Supercede are some of the smartest, focused, and most hard-working I’ve ever met.

They’re also great at reinsurance-based memes - we post the most popular, as voted by internally, to our LinkedIn on Fridays.

The unique combination of a marvellous team, compelling solution, and proven product-market fit made the jump to reinsurance an easy one.